About

Resimac

Resimac is one of Australia’s premier non-bank lenders. We offer competitive interest rates and flexible home loan options with great features including offset accounts and the ability to make extra repayments and redraw funds.

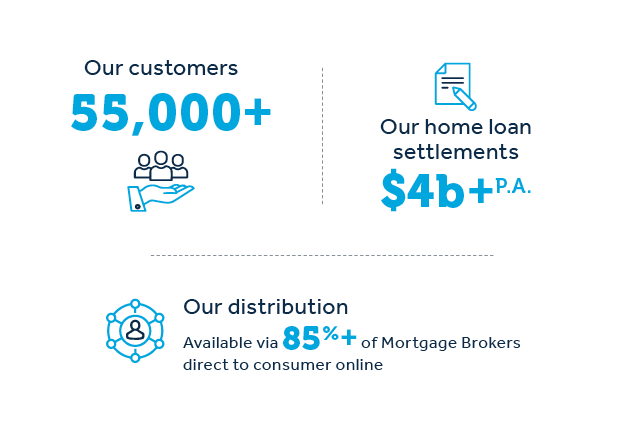

Thanks to our flexible funding programme, we provide solutions to a wide range of customers including the self-employed and contractors, as well as customers with previous credit impairments through our network of over 12,000 broker partners.

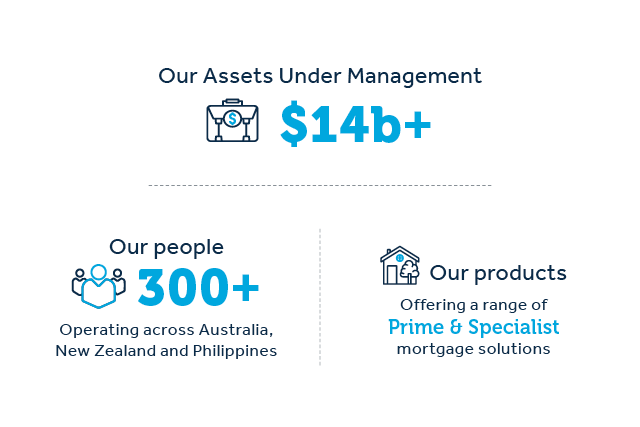

With a history dating back to 1985, Resimac has a proven track record of growth and stability. We are pleased to service over 55,000 customers with a portfolio of home loans on balance sheet of almost $13 billion, an asset finance portfolio over $1 billion, and total assets under management of over $14 billion. As we are listed on the Australian Securities Exchange (ASX), our customers have the assurance that we adhere to the ASX’s strict standards on reporting and transparency in the way we run our business.

As well as being regulated by the Australian Securities and Investments Commission (ASIC), we are also members of the Australian Financial Complaints Authority (AFCA). This means that in the rare occurrence that a complaint is lodged, a customer has recourse via an independent authority if they are dissatisfied with our response.

We are a full member of the Mortgage & Finance Association of Australia (MFAA).

Our

history

The Resimac journey began in 1985, when both FANMAC and International Financing & Investment (IF&I) were formed. By 2001 these had evolved into RESIMAC and Homeloans Ltd respectively, before merging in 2016 to form a leading Australian non-bank lender.

In 1988, FANMAC was Australia's first issuer of Residential Mortgage-Backed Securities (RMBS). In 2001 FANMAC rebranded to RESIMAC and in 2007 launched our specialist lending products, which would become a staple component of the non-bank sector. We continued to grow our funding and wholesale distribution capabilities throughout the 2010s.

Meanwhile, IF&I was established as a mortgage originator before driving the emergence of the non-bank sector in the mid-1990s as WA Homeloans and subsequently other state brands. Listed on the ASX in 2001, we then consolidated brands into a national identity, Homeloans Ltd. Throughout the 2000s we strengthened our recipe of principally-funded and wholesale-sourced funding, and cultivated distribution relationships with a number of mortgage aggregator networks.

In 2016, RESIMAC and Homeloans merged, with RESIMAC Ltd becoming a wholly owned subsidiary of Homeloans. In 2018 shareholders voted to rename the company as Resimac Group Ltd, and the Homeloans and RESIMAC brands were consolidated and relaunched as Resimac.

Resimac's

core values

These values reflect what’s important to the Group. They guide our efforts, define our culture, shape the way we approach development and change, as we aim for more ambitious goals. We understand the requirements of our customers, employees and stakeholders and are building a best-in-class business that delivers against those requirements.

We are committed to treating our people, partners, and customers with the utmost respect, fostering a culture of trust and collaboration which is fundamental to our success.

We are focused and action-oriented, dedicated to making a meaningful impact for our people, partners and customers. With purposeful action and intent, we strive to achieve shared goals and create a successful future.

We embrace opportunity. We are dedicated to creating development opportunities for our people, pursuing growth opportunities for our organisation, and fostering mutually beneficial partnerships. Together, we aspire to unlock the full potential of every opportunity.

We resolve to hold ourselves accountable. By fostering a culture of accountability, we aspire to be a trusted partner for our people and our stakeholders, delivering on our promises with integrity and transparency. We are dedicated to fairness and equity in all that we do, aligning our actions with community expectations.

Login

Login